Tick tock. Time is running out. The new federal overtime regulations go into effect December 1, 2016. Starting then, most white-collar employees whose weekly salaries are lower than $913 are eligible for overtime pay. As a result, the Department of Labor estimates employers will distribute almost $1.4 billion more in salaries and overtime.

That’s a big change. How big? The DOL expects it’ll cost nearly $593 million just for employers to prepare for the switch. At the same time, the department doesn’t believe adjusting to the new law will be a lengthy process for businesses.

Look in the Mirror

Before stressing out about the overtime law, make sure your company is involved. For the most part, the regulations cover businesses that have annual sales of at least $500,000 or that participate in interstate commerce. However, hospitals, medical centers, nursing care facilities, schools and public agencies are included as well. Many non-profits are exempt.

Who’s In, Who’s Out

If you’ve determined your business falls under the new regs, several steps will help ensure you’re on-track by the time December rolls around. Initially, identify which employees are impacted. This includes examining job descriptions to make certain they match what workers actual do. This guarantees that employees are properly classified as exempt or non-exempt under the new law.

Status isn’t just about salary levels. For some workers, it depends upon position. Many computer specialists, outside sales employees, commissioned retail workers, executives, administrators and licensed professionals are exempt from the new law. For the employees included under the changes, estimate how many hours per week each works.

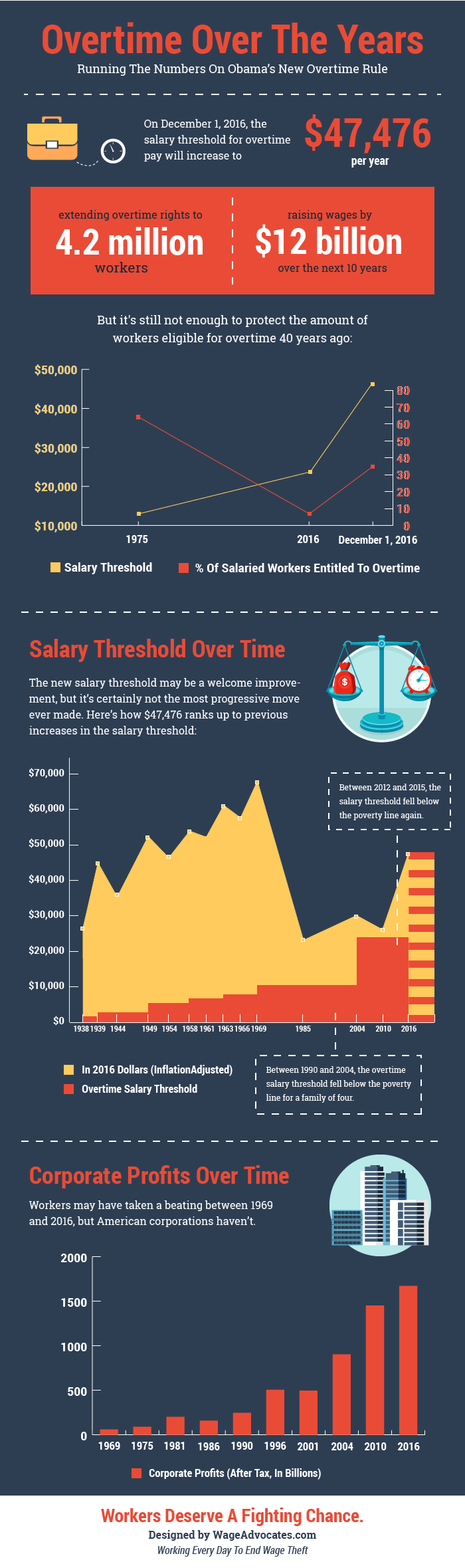

While the federal law will likely cover an additional 4.2 million people, don’t forget to consider state regulations. If your state’s guidelines are more protective, follow them. That’s a requirement, not a choice.

Calculate Cost

Once you have information about employee schedules, determine your costs if the regulations kick in and no changes are made to salaries, work schedules or responsibilities. You may see little effect if most workers don’t go over 40 hours per week. If they do, you have options. Take your data on who’s involved and how much it will cost, and move on to the next step.

This, That or the Other

Now that you know which of your employees will be affected, it’s decision time. If you make changes, consider how they influence benefits and job titles. You have several choices:

- Pay newly covered employees one-and-a-half times their regular rates when they put in extra hours.

- Raise the salaries of employees above the cut-off point so they are no longer included under the new law.

- Limit overtime work.

- Set new guidelines for afterhours and weekend work.

- Examine job descriptions, and then reassign or cancel some job responsibilities so employees don’t need to work overtime.

- Hire part-time employees to handle unfinished work.

- Outsource certain duties.

- Reclassify salaried employees to hourly and pay overtime, if necessary.

- Adjust start and stop times.

Get a Handle on Time

Under the new law, employers must keep track of the employees’ time so extra hours are compensated properly. There’s no one-size-fits-all approach. Employers can choose the method that works best for their circumstances. For instance:

- Employees punch a time clock.

- Employer and employee agree on a set schedule. Workers report changes to their standard hours.

- Employees with flexible schedules report the number of hours worked at the end of a pay period.

- Employees use mobile devices to let you carry out workforce management online. Software digitally reports their hours. These systems provide alerts when workers’ hours are nearing overtime levels.

- Employees track their hours manually. This generally has a two percent error rate. A business that selects this route should start recording hours before the new law is in place so kinks can be worked out.

Talk It Out

Once you’ve determined how you’ll handle the new law, create a plan to present it to your employees. It’s not only about communicating the changes. It’s about handling questions and concerns from both management and staff. Don’t wait until the last minute, because workers may need training for new procedures, policies and technology.

Consider Fallout

Workers who earn more may be very happy with the new regulations. Not everyone might welcome the changes you’re making with open arms, however. They can affect morale. Be prepared to deal with many types of grievances. For instance:

- If you require employees to start punching a clock, some may see it as a demotion, since their time wasn’t closely monitored previously.

- There may be some resentment if you shift duties among employees in order to limit overtime.

- Workers might resent independent contractors and part-time employees brought in to handle extra work.

- Employees whose statuses change may be unhappy.

Keep Your Eyes Open

Once you implement changes to your business, closely monitor their effects. Make sure employees fully understand and comply with your new policies. Provide whatever feedback and support are necessary during the transition period.

Though many workers will undoubtedly benefit from the new overtime law, following it will be challenging for businesses. If you’re unsure about your ability to adapt successfully, consider bringing in legal help. Mistakes can be costly. DOL auditors will monitor how businesses implement the law. In fact, in 2017, the department will have $277 million in their budget to enforce wage and overtime regulations. You don’t want to go up against that.

0 Comments